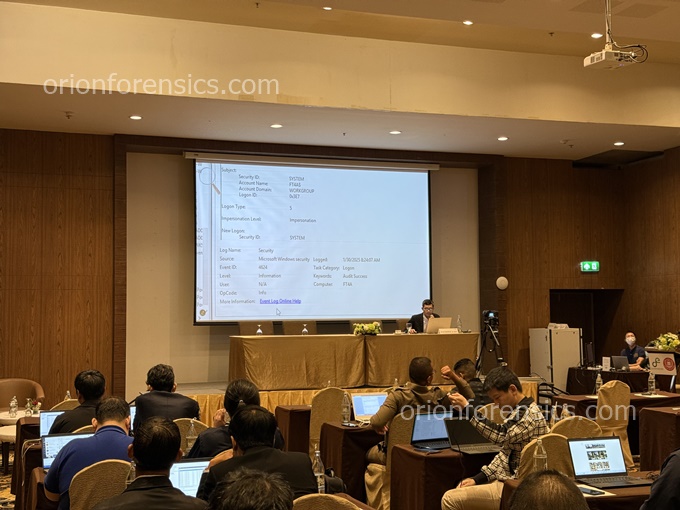

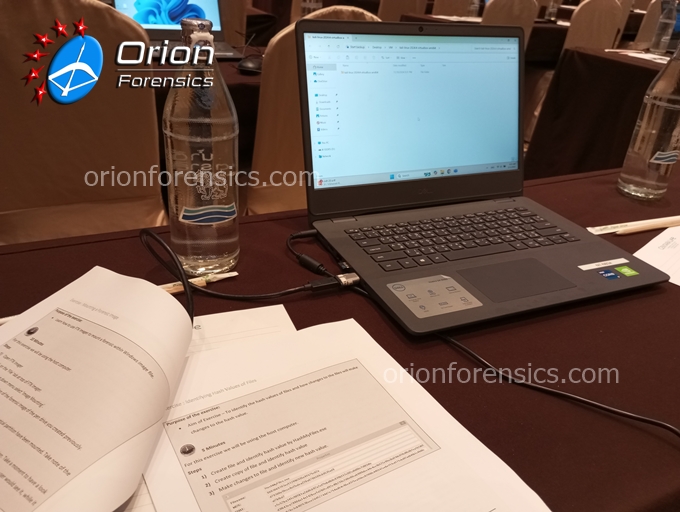

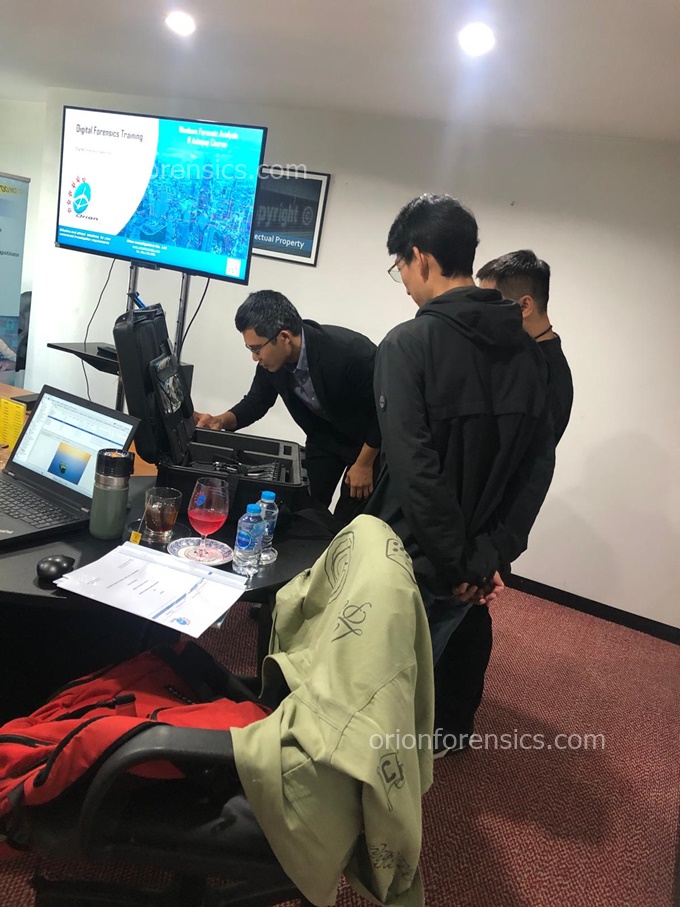

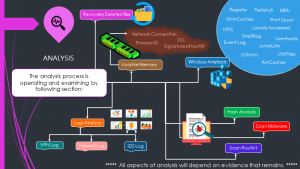

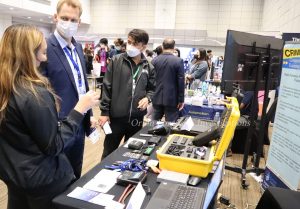

On February 6-7, 2025, National Telecom Public Company Limited (NT) invited experts from Orion Investigation Co., Ltd. as guest lecturers for a specialized training program. This program, titled “Training for Officers Under the Computer Crime Act,” is Computer forensics Investigations Course 2 Day (Intensive Course)

With 50 onsite participants and additional attendees joining online, the training aimed to enhance knowledge and expertise in computer forensics. The goal was to equip officers with the skills needed to effectively apply digital forensic techniques in their duties with accuracy and efficiency.

The event took place at Centara Life Government Complex & Convention Center, Chaeng Watthana, Bangkok.

Looking for expert-led digital forensics training? Orion Investigation provides professional Computer Forensics services, corporate training, and cybersecurity consulting.

Please contact Orion Forensics Email : ![]()