Corporate Fraud and Covid-19

Fraud is an intentional act to deprive another of property or money by guile, deception, or other unfair means. Corporate fraud is fraud against a company and can be committed by internal or external parties. Internal fraud is when an employee, manager, or owner commits fraud against their own company such as theft or misuse of company assets. External fraud is committed by third-parties and includes bribery, corruption, hacking, theft and insurance, loans and payment frauds.

It is estimated that organizations globally lose 5 percent of gross revenue to fraud.

A general understanding of human nature and crime may lead us to believe that corporate fraud is committed by employees with bad intentions and a faulty moral compass. However, fraud experts, after analyzing thousands of cases of corporate fraud, have found that other factors are more important in leading an employee to commit fraud.

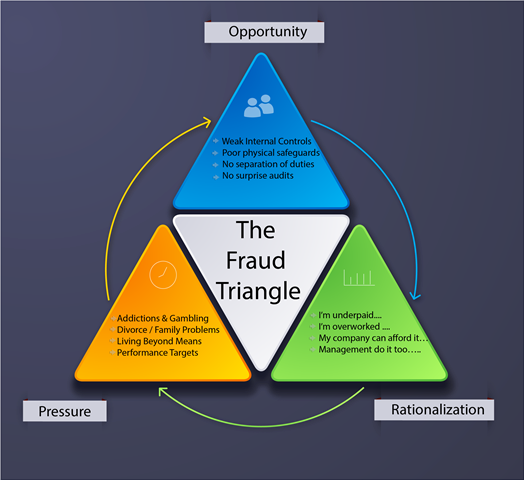

These factors are illustrated in the Fraud Triangle. The Fraud Triangle consists of Opportunity, Pressure, and Rationalization. To take a simple example – The petty cash draw in Jack’s company is never locked, is not monitored, and is never reconciled. He has an Opportunity. He is low on cash, it is his girlfriend’s birthday and he has not bought a present yet. He has Pressure. A few hundred dollars will not harm the company, nobody will find out, he is underpaid, and overworked and his boss is an idiot. He now has Rationalization and all three boxes are ticked for Jack to become a corporate fraudster, despite being a generally ethical and well-intentioned employee.

How can the Fraud Triangle help us understand the threat of fraud during the Covid-19 pandemic?

Opportunities – while working from home, many companies have had to quickly introduce new work-processes with fewer controls. Pressure – we all know the pressure faced by many during the pandemic due to uncertainties, reduced salaries, family crises and general anxiety levels. Rationalization – while working from home, employees may feel less connected to their employer and colleagues or they may feel dissatisfaction with their employer for measures taken during the pandemic, such as salary reductions or redundancies, making it easier for them to justify committing fraud.

The Association of Fraud Examiners (ACFE) – the world’s largest anti-fraud organization and provider of anti-fraud training and education (and the source of most of the statistics presented in this article) – has observed a significant increase in fraud as a result of Covid-19. Especially in employee embezzlement, cyber fraud, payment fraud and identity theft caused by less oversight due to remote workforces. ACFE members also report challenges to investigating fraud due to travel restrictions and other lack of access to evidence.

While Covid-19 may have created new opportunities and different kinds of fraud, the fundamentals of fraud and how companies can protect themselves from fraud remain the same. The following are some of the key tools available to companies to reduce the risk of being victims of fraud –

-

- Hotlines – 43 percent of frauds are detected through tips. Organizations with hotlines detect fraud sooner and limit their losses. This illustrates the importance of having a clear reporting mechanism for employees, suppliers, and others to report suspicions of fraud. Most fraudsters are not saving for a rainy day – they tend to live beyond their means and colleagues may pick up on this and report their suspicions. Other red flags of fraud include financial difficulties, unusually close relationships with vendors/customers and addictions.

- Fraud Awareness Training – Employees are more likely to provide tips after they have received training on fraud. They are also less likely to commit fraud if they are aware of the company’s code of conduct and anti-fraud policies and internal controls. Topics will include red flags of fraud, types of fraud, and fraud reporting processes.

- Tone at the Top – Many factors in the Rationalization of a fraud involve poor management. Management and owners must set an example in terms of ethical behaviour and fair treatment of employees and vendors.

- Incident Response Plans – Companies should have a plan in place for how they will respond to fraud or allegations of fraud. This may include identifying external resources that can be called upon to support investigations and legal actions. Once fraud is detected, it is important to collect evidence in a forensically sound manner so it can be used in legal proceedings if necessary. Evidence should also be carefully reviewed before deciding whether legal action can be taken against the fraudsters. Companies often rush to confront a fraudster before sufficient evidence has been gathered to strengthen the company’s position.

- Internal Controls – Most companies will not have the open Petty Cash drawer that helped corrupt poor Jack, but many have comparable vulnerabilities that employees will become aware of over time. Having tighter internal controls including separation of duties, physical safeguards, and surprise audits will reduce the Opportunity factors in the fraud triangle. Many external auditors will also provide internal control review services.

- Fraud Risk Assessments – This involves proactively identifying and mitigating the company’s vulnerabilities to internal and external fraud. It can be done internally or with the support of outside consultants.

- External Audits – External audits of financial statements are also a significant source of fraud discoveries, especially in larger organizations. Identifying potential frauds should be included in the scope of engagement with external auditors.

- Pre-Employment Screening – These include checking of past employment duties, criminal and background checks, educational verification, and reference checks. Organizations should ensure that their employment screening processes comply with data protection laws, with no unauthorized accessing of applicants’ data, and consider the use of a professional screening company.

As the saying goes, prevention is better than cure. Implementing these anti-fraud tools will reduce the risk of your organization becoming a victim of fraud. It will also ensure that, if you do become a victim of fraud, the response will be swift and appropriate, and the damage will be limited.

Author : Peter Holmshaw – Managing Director at Orion Investigation Co.,Ltd.

Read More

Dealing with Cyber Crime – Would your business know how to respond

They say there are two certainties in life, death and taxes. I would suggest that there are now three. Death, taxes and being confronted with cybercrime. It is not uncommon to hear the phrase cybercrime or cyberterrorism being used in the media and how another major company has been hacked. Yet many people are still unsure exactly what constitutes cybercrime and whether they may have been a victim.

Read More